분류 전체보기

Beijinger

2021. 4. 18. 16:21

2021. 4. 18. 16:21

2021년 4월 18일

2021년 4월 18일

| 종목명 |

티커 |

권리대분류 |

권리소분류 |

권리내용 |

권리락일 |

| Realty Income |

O |

배당 |

현금배당 |

0.235USD(월간배당) |

2021년 4월 30일 |

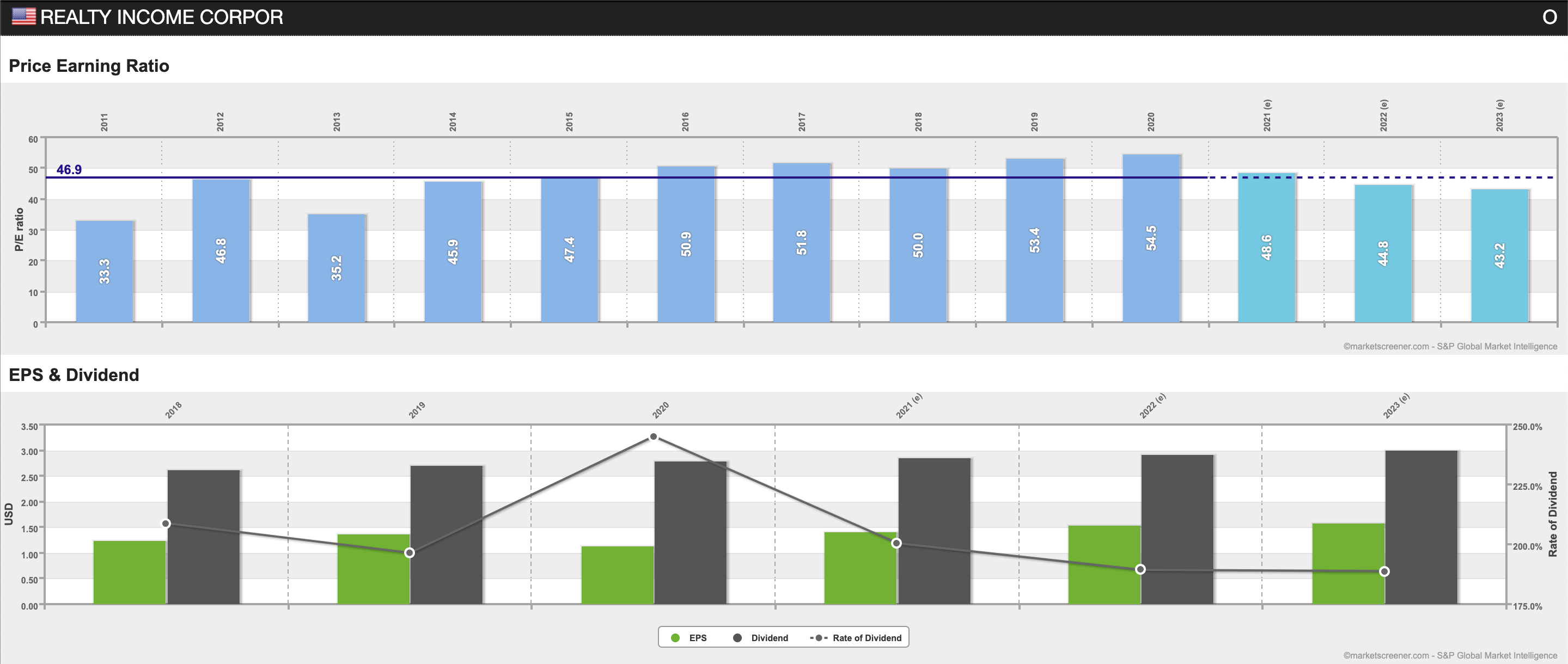

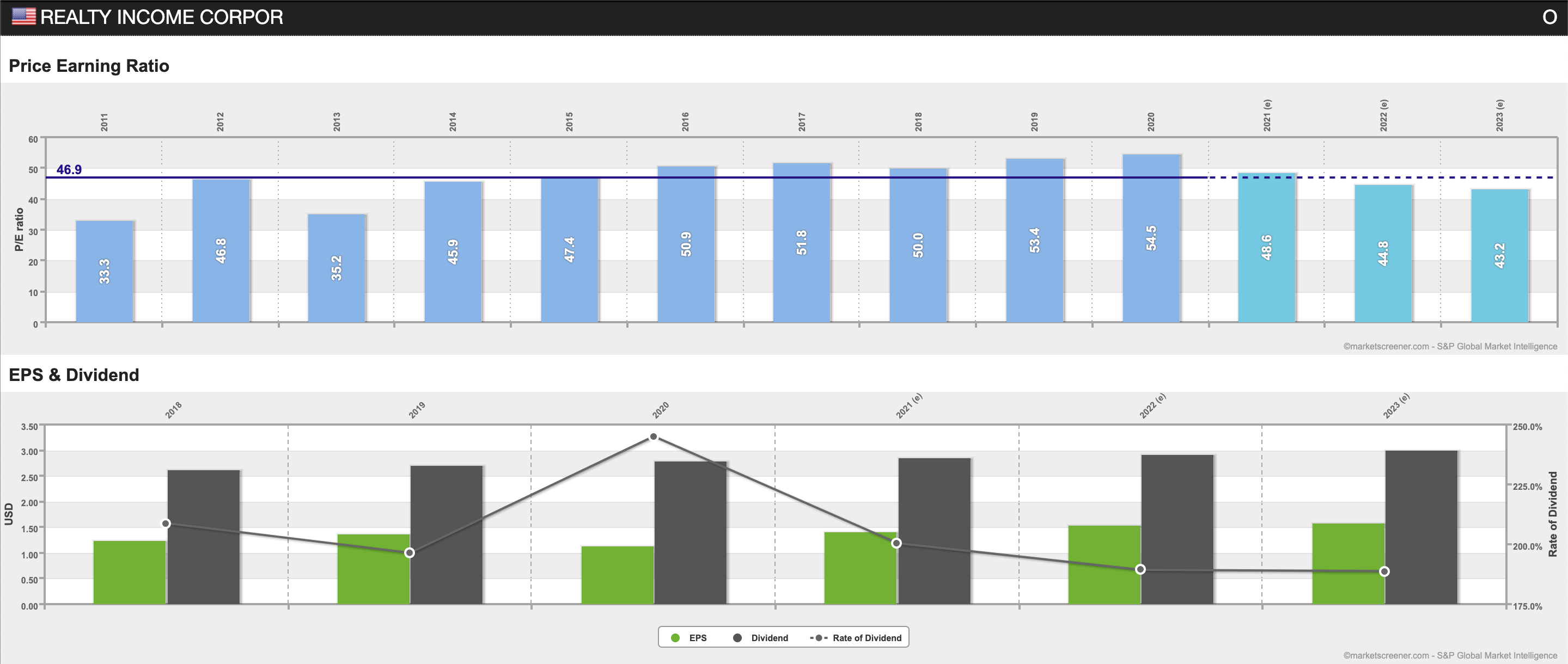

REALTY INCOME (NYSE:O) DIVIDEND INFORMATION

| O Dividend Date |

5/14/2021 |

| O Annual Dividend |

$2.82 |

| O Dividend Yield |

4.21% |

| O Three Year Dividend Growth |

10.41% |

| O Payout Ratio |

84.94% (Trailing 12 Months of Earnings)

82.94% (Based on This Year's Estimates)

80.57% (Based on Next Year's Estimates)

75.36% (Based on Cash Flow) |

| O Dividend Track Record |

27 Years of Consecutive Dividend Growth |

| O Dividend Frequency |

Monthly Dividend |

| O Most Recent Increase |

$0.005 increase on 3/16/2014 |

REALTY INCOME (NYSE:O) DIVIDEND HISTORY BY MONTHLY

| Announced |

Period |

Amount |

Yield |

Ex-Dividend Date |

Record Date |

Payable Date |

| 4/15/2021 |

monthly |

$0.2350 |

4.2% |

4/30/2021 |

5/3/2021 |

5/14/2021 |

| 3/16/2021 |

Monthly |

$0.2350 |

4.41% |

3/31/2021 |

4/1/2021 |

4/15/2021 |

| 2/18/2021 |

feb 21 |

$0.2345 |

4.5% |

2/26/2021 |

3/1/2021 |

3/15/2021 |

| 1/15/2021 |

Monthly |

$0.2345 |

4.87% |

1/29/2021 |

2/1/2021 |

2/16/2021 |

| 12/8/2020 |

jan 21 |

$0.2345 |

4.7% |

12/31/2020 |

1/4/2021 |

1/15/2021 |

| 11/10/2020 |

nov 20 |

$0.2340 |

4.5% |

11/30/2020 |

12/1/2020 |

12/15/2020 |

| 10/15/2020 |

oct 20 |

$0.2340 |

4.8% |

10/30/2020 |

11/2/2020 |

11/13/2020 |

| 10/15/2020 |

oct 20 |

$0.2340 |

10/30/2020 |

11/2/2020 |

11/13/2020 |

|

| 9/17/2020 |

oct 20 |

$0.2340 |

4.7% |

9/30/2020 |

10/1/2020 |

10/15/2020 |

| 8/18/2020 |

sep 20 |

$0.2335 |

4.6% |

8/31/2020 |

9/1/2020 |

9/15/2020 |

Beijinger

2021. 4. 18. 00:47

2021. 4. 18. 00:47

Beijinger

2021. 4. 18. 00:45

2021. 4. 18. 00:45

Beijinger

2021. 4. 17. 03:16

2021. 4. 17. 03:16

2021년 4월 17일

2021년 4월 17일

| 종목명 |

티커 |

권리대분류 |

권리소분류 |

권리내용 |

권리락일 |

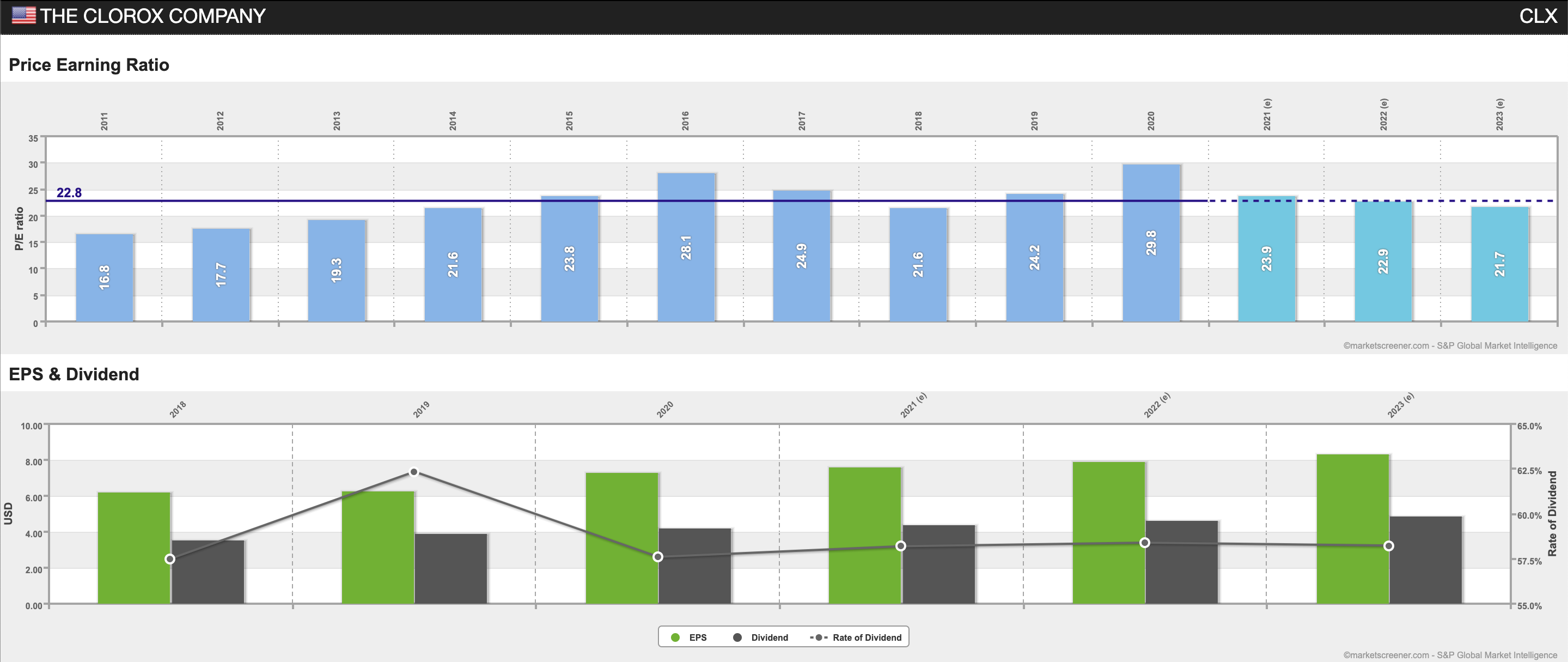

| 크로락스 |

CLX.US |

배당 |

현금배당 |

1.11USD(분기배당) |

2021년 4월 20일 |

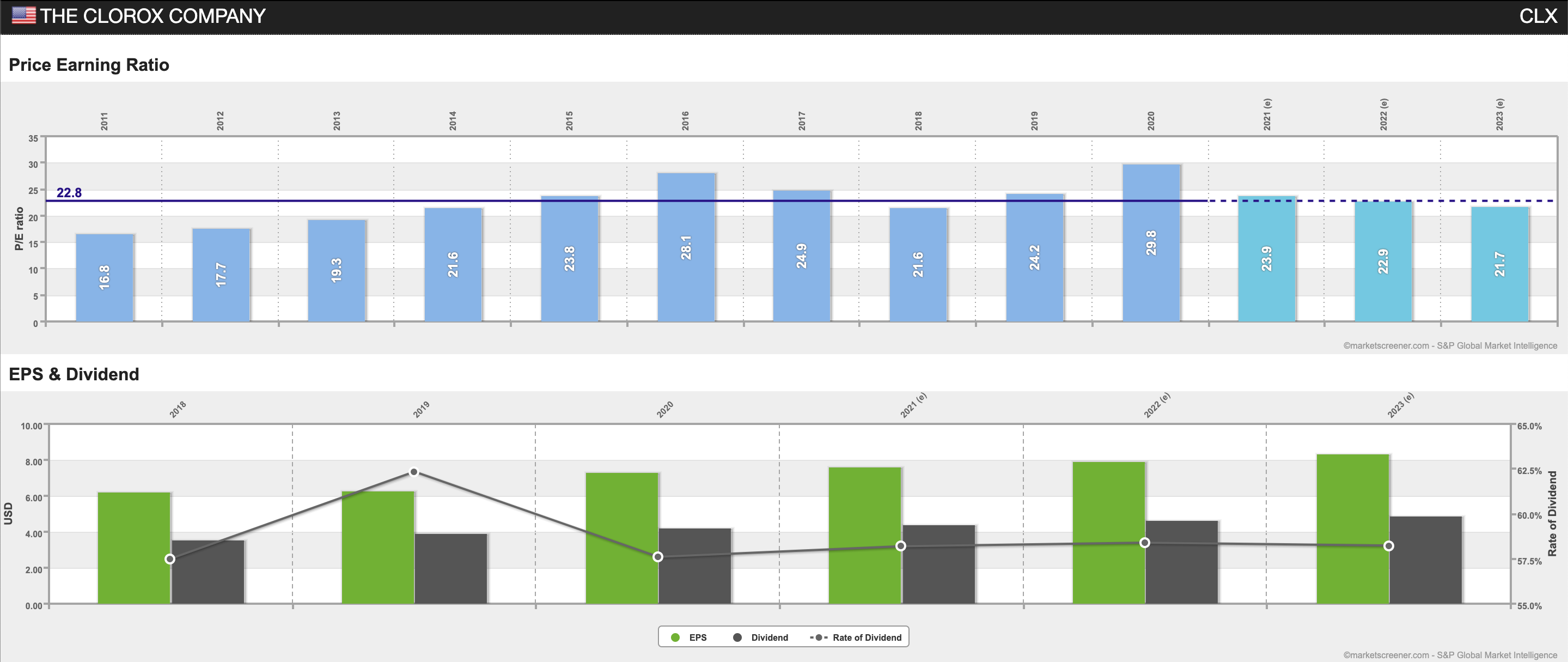

THE CLOROX (NYSE:CLX) DIVIDEND INFORMATION

| CLX Dividend Date |

5/7/2021 |

| CLX Annual Dividend |

$4.44 |

| CLX Dividend Yield |

2.32% |

| CLX Three Year Dividend Growth |

32.32% |

| CLX Payout Ratio |

60.33% (Trailing 12 Months of Earnings)

55.29% (Based on This Year's Estimates)

55.50% (Based on Next Year's Estimates)

51.71% (Based on Cash Flow) |

| CLX Dividend Track Record |

45 Years of Consecutive Dividend Growth |

| CLX Dividend Frequency |

Quarterly Dividend |

| CLX Most Recent Increase |

$0.05 increase on 5/21/2020 |

THE CLOROX (NYSE:CLX) DIVIDEND HISTORY BY QUARTER

| Announced |

Period |

Amount |

Yield |

Ex-Dividend Date |

Record Date |

Payable Date |

| 2/9/2021 |

quarterly |

$1.11 |

2.37% |

4/20/2021 |

4/21/2021 |

5/7/2021 |

| 11/17/2020 |

quarterly |

$1.11 |

2.12% |

1/26/2021 |

1/27/2021 |

2/12/2021 |

| 9/22/2020 |

quarterly |

$1.11 |

2.09% |

11/3/2020 |

11/4/2020 |

11/20/2020 |

| 5/21/2020 |

quarterly |

$1.11 |

2.2% |

7/28/2020 |

7/29/2020 |

8/14/2020 |

| 2/11/2020 |

Quarterly |

$1.06 |

2.58% |

4/21/2020 |

4/22/2020 |

5/8/2020 |

| 11/19/2019 |

Quarterly |

$1.06 |

2.92% |

1/28/2020 |

1/29/2020 |

2/14/2020 |

| 9/17/2019 |

quarterly |

$1.06 |

2.73% |

10/29/2019 |

10/30/2019 |

11/15/2019 |

| 5/22/2019 |

quarterly |

$1.06 |

2.82% |

7/30/2019 |

7/31/2019 |

8/16/2019 |

| 2/14/2019 |

quarterly |

$0.96 |

2.46% |

4/23/2019 |

4/24/2019 |

5/10/2019 |

| 11/13/2018 |

Quarterly |

$0.96 |

2.4% |

1/22/2019 |

1/23/2019 |

2/8/2019 |

Beijinger

2021. 4. 17. 02:53

2021. 4. 17. 02:53

2021년 4월 17일

2021년 4월 17일

| 종목명 |

티커 |

권리대분류 |

권리소분류 |

권리내용 |

권리락일 |

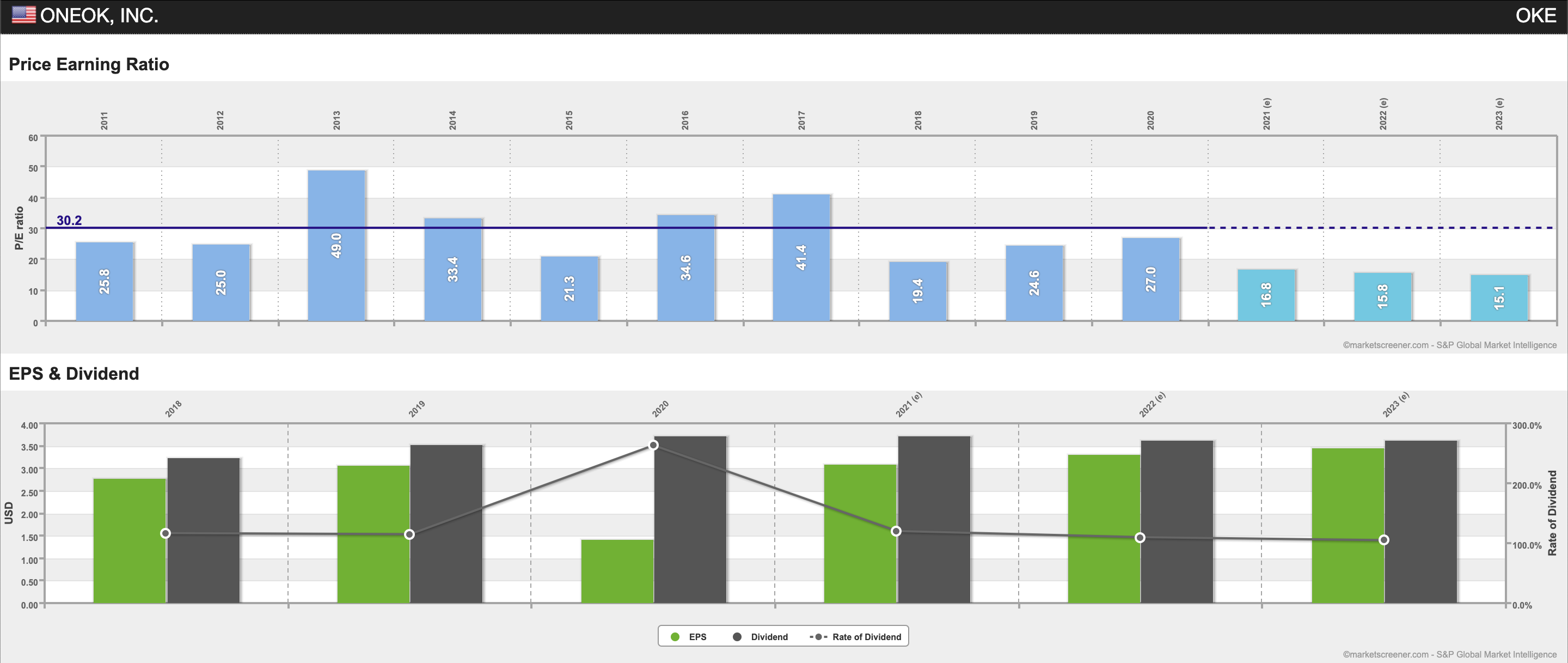

| 원오케이(Oneok) |

OKE.US |

배당 |

현금배당 |

0.935USD(분기배당) |

2021년 4월 26일 |

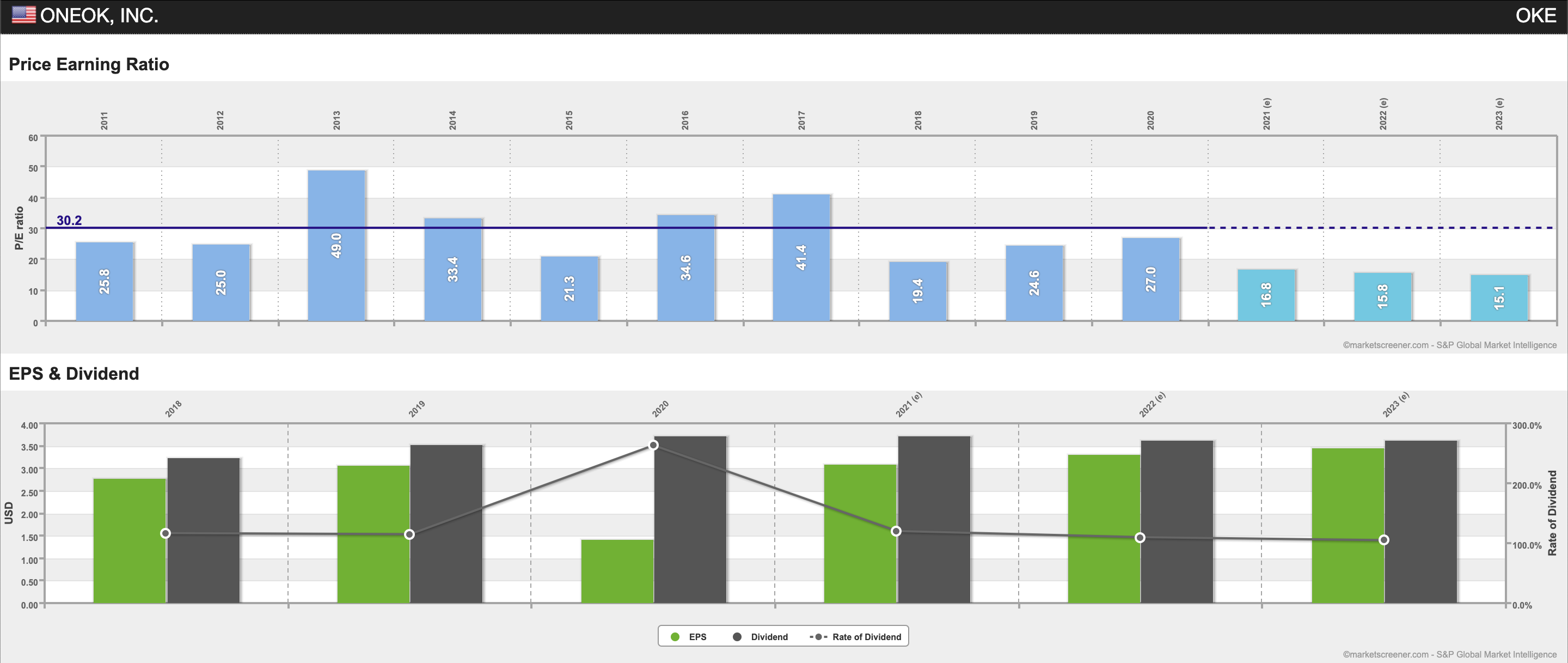

ONEOK (NYSE:OKE) DIVIDEND INFORMATION

| OKE Dividend Date |

5/14/2021 |

| OKE Annual Dividend |

$3.74 |

| OKE Dividend Yield |

7.23% |

| OKE Three Year Dividend Growth |

37.50% |

| OKE Payout Ratio |

121.82% (Trailing 12 Months of Earnings)

146.09% (Based on This Year's Estimates)

129.41% (Based on Next Year's Estimates)

74.44% (Based on Cash Flow) |

| OKE Dividend Track Record |

1 Years of Consecutive Dividend Growth |

| OKE Dividend Frequency |

Quarterly Dividend |

| OKE Most Recent Increase |

$0.02 increase on 1/15/2020 |

ONEOK (NYSE:OKE) DIVIDEND HISTORY BY QUARTER

| Announced |

Period |

Amount |

Yield |

Ex-Dividend Date |

Record Date |

Payable Date |

| 4/15/2021 |

quarterly |

$0.9350 |

7.14% |

|

4/26/2021 |

5/14/2021 |

| 1/20/2021 |

quarterly |

$0.9350 |

8.5% |

1/29/2021 |

2/1/2021 |

2/12/2021 |

| 10/21/2020 |

quarterly |

$0.9350 |

13.16% |

10/30/2020 |

11/2/2020 |

11/13/2020 |

| 7/22/2020 |

quarterly |

$0.9350 |

12.68% |

7/31/2020 |

8/3/2020 |

8/14/2020 |

| 4/16/2020 |

quarterly |

$0.9350 |

14.08% |

4/24/2020 |

4/27/2020 |

5/14/2020 |

| 1/15/2020 |

quarterly |

$0.9350 |

4.93% |

1/24/2020 |

1/27/2020 |

2/14/2020 |

| 10/23/2019 |

quarterly |

$0.9150 |

5.16% |

11/1/2019 |

11/4/2019 |

11/14/2019 |

| 7/24/2019 |

quarterly |

$0.89 |

1.46% |

8/5/2019 |

8/6/2019 |

8/14/2019 |

| 4/18/2019 |

quarterly |

$0.8650 |

5% |

4/26/2019 |

4/29/2019 |

5/15/2019 |

| 1/16/2019 |

quarterly |

$0.86 |

5.62% |

1/25/2019 |

1/28/2019 |

2/14/2019 |