아메리카(배당예정)/미국

Beijinger

2021. 6. 11. 03:12

2021. 6. 11. 03:12

2021년 6월 11일

2021년 6월 11일

| 종목명 |

티커 |

권리대분류 |

권리소분류 |

권리내용 |

권리락일 |

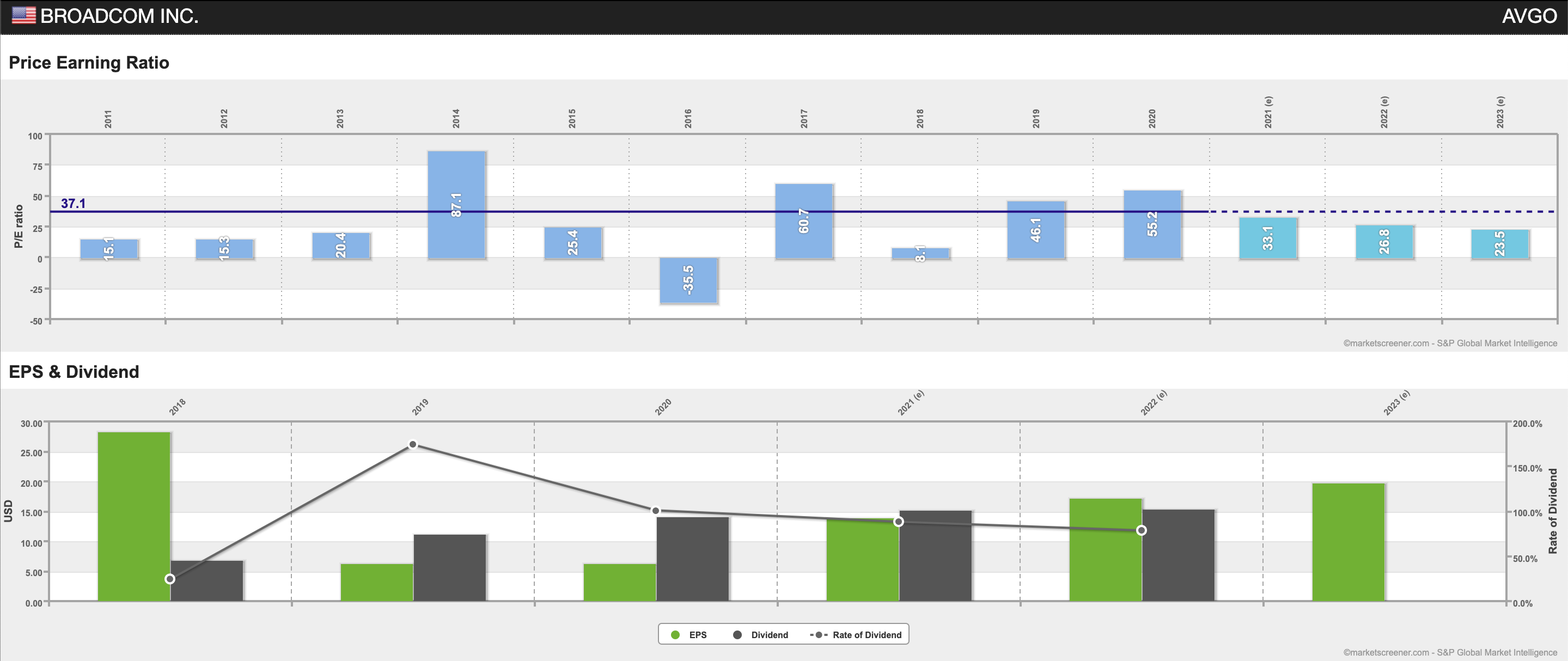

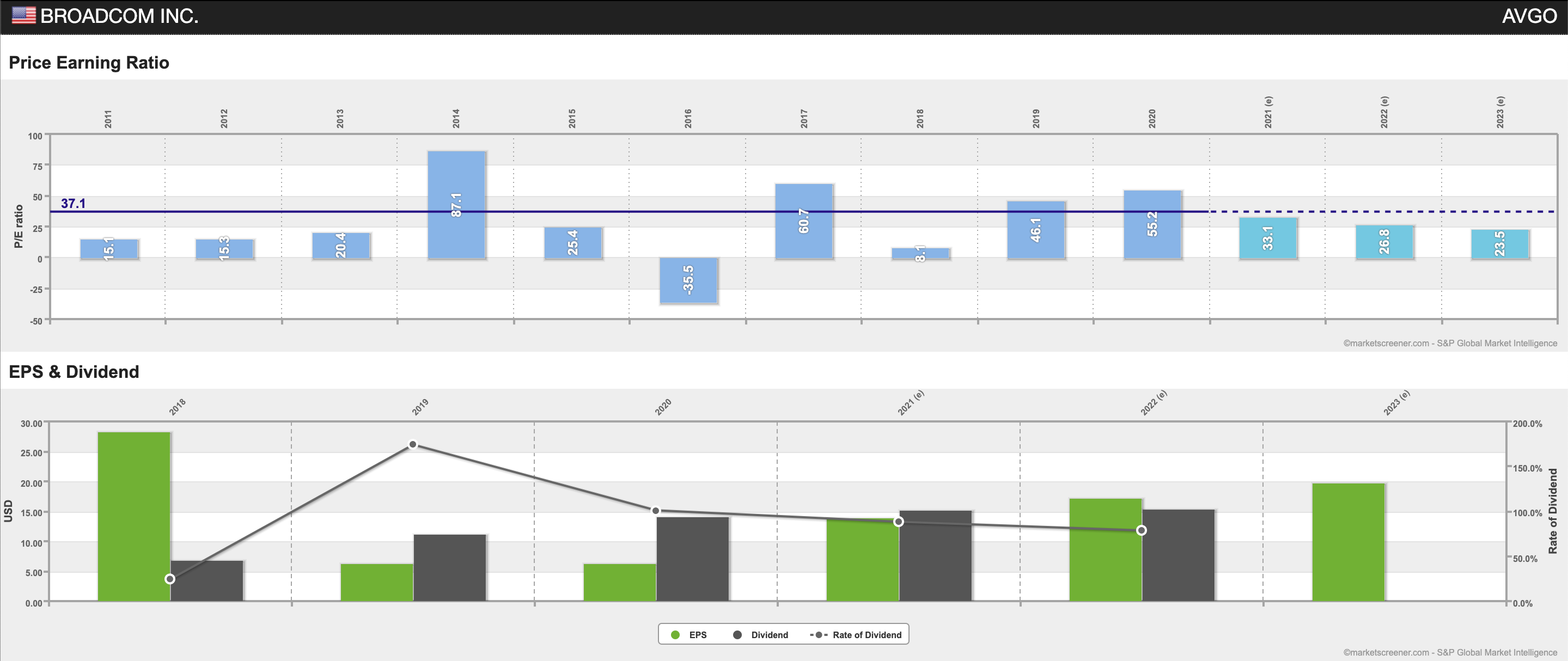

| 브로드컴 |

AVGO.US |

배당 |

현금배당 |

3.6USD(분기배당) |

2021년 6월 21일 |

BROADCOM (NASDAQ:AVGO) DIVIDEND INFORMATION

| AVGO Dividend Date |

6/30/2021 |

| AVGO Annual Dividend |

$14.40 |

| AVGO Dividend Yield |

3.10% |

| AVGO Three Year Dividend Growth |

177.55% |

| AVGO Payout Ratio |

78.05% (Trailing 12 Months of Earnings)

61.15% (Based on This Year's Estimates)

54.26% (Based on Next Year's Estimates)

38.09% (Based on Cash Flow) |

| AVGO Dividend Track Record |

10 Years of Consecutive Dividend Growth |

| AVGO Dividend Frequency |

Quarterly Dividend |

| AVGO Most Recent Increase |

$0.35 increase on 12/10/2020 |

BROADCOM (NASDAQ:AVGO) DIVIDEND HISTORY BY QUARTER

| Announced |

Period |

Amount |

Yield |

Ex-Dividend Date |

Record Date |

Payable Date |

| 6/3/2021 |

quarterly |

$3.60 |

3.1% |

6/21/2021 |

6/22/2021 |

6/30/2021 |

| 3/4/2021 |

quarterly |

$3.60 |

3.23% |

3/19/2021 |

3/22/2021 |

3/31/2021 |

| 12/10/2020 |

quarterly |

$3.60 |

3.53% |

12/18/2020 |

12/21/2020 |

12/31/2020 |

| 9/3/2020 |

quarterly |

$3.25 |

3.63% |

9/21/2020 |

9/22/2020 |

9/30/2020 |

| 6/4/2020 |

quarterly |

$3.25 |

4.21% |

6/19/2020 |

6/22/2020 |

6/30/2020 |

| 3/12/2020 |

quarterly |

$3.25 |

5.94% |

3/20/2020 |

3/23/2020 |

3/31/2020 |

| 12/12/2019 |

quarterly |

$3.25 |

3.97% |

12/20/2019 |

12/23/2019 |

12/31/2019 |

| 9/12/2019 |

quarterly |

$2.65 |

3.53% |

9/20/2019 |

9/23/2019 |

10/1/2019 |

| 6/13/2019 |

quarterly |

$2.65 |

3.76% |

6/21/2019 |

6/24/2019 |

7/2/2019 |

| 3/14/2019 |

quarterly |

$2.65 |

3.95% |

3/20/2019 |

3/21/2019 |

3/29/2019 |

Beijinger

2021. 6. 11. 02:28

2021. 6. 11. 02:28

2021년 6월 11일

2021년 6월 11일

| 종목명 |

티커 |

권리대분류 |

권리소분류 |

권리내용 |

권리락일 |

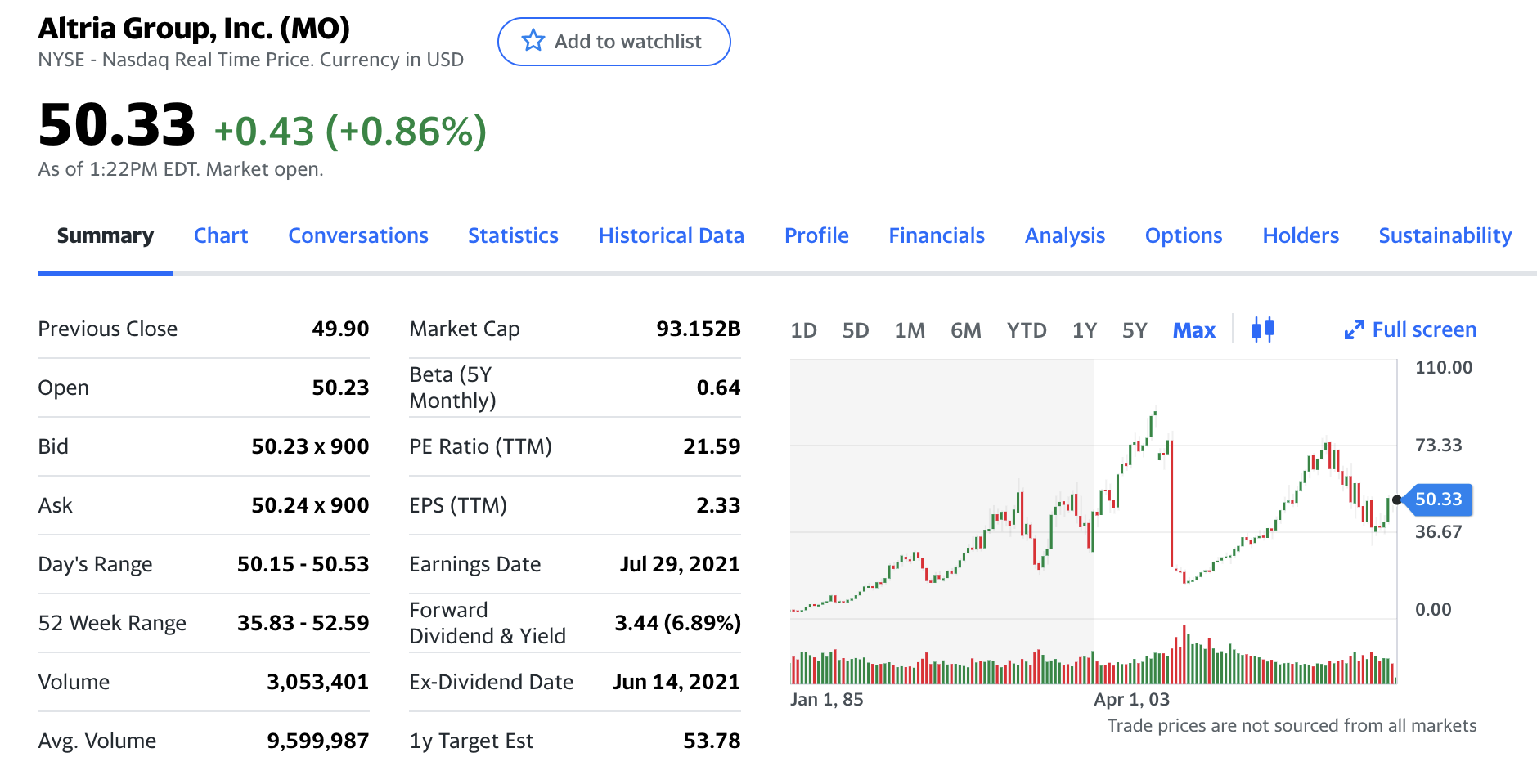

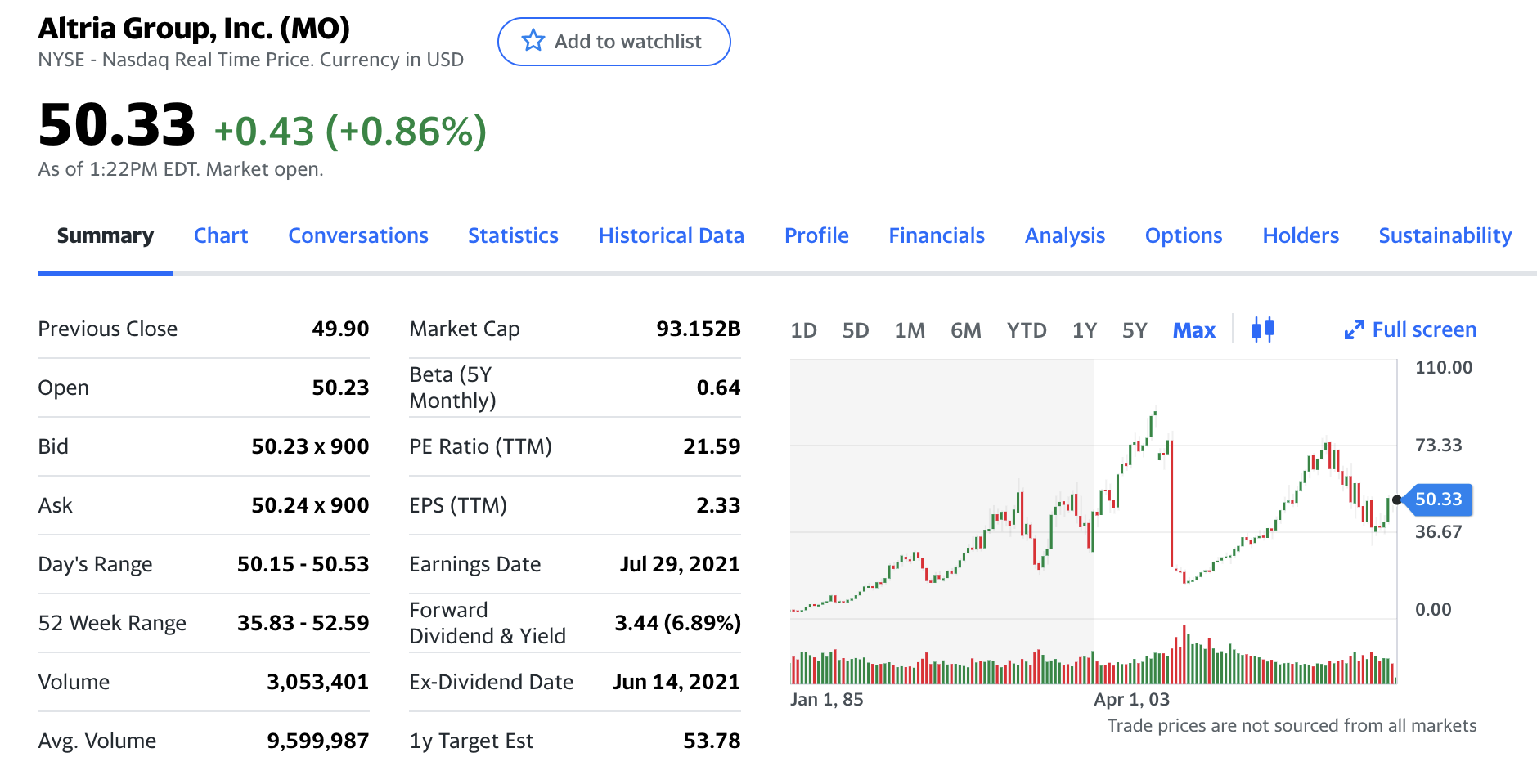

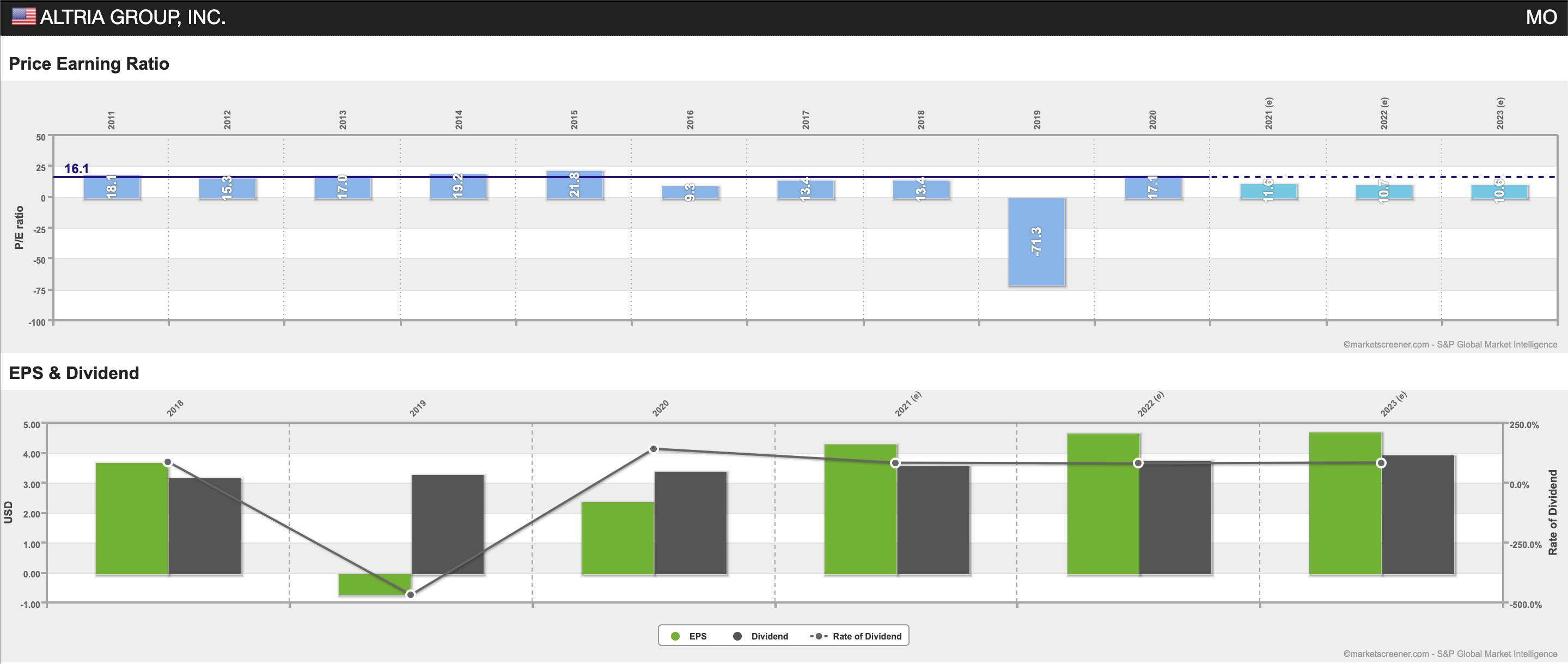

| 알트리아 그룹 |

MO.US |

배당 |

현금배당 |

0.86USD(분기배당) |

2021년 6월 14일 |

ALTRIA GROUP (NYSE:MO) DIVIDEND INFORMATION

| MO Dividend Date |

7/9/2021 |

| MO Annual Dividend |

$3.44 |

| MO Dividend Yield |

6.85% |

| MO Three Year Dividend Growth |

0.00% |

| MO Payout Ratio |

78.90% (Trailing 12 Months of Earnings)

75.27% (Based on This Year's Estimates)

71.07% (Based on Next Year's Estimates)

76.69% (Based on Cash Flow) |

| MO Dividend Track Record |

12 Years of Consecutive Dividend Growth |

| MO Dividend Frequency |

Quarterly Dividend |

| MO Most Recent Increase |

$0.02 increase on 7/28/2020 |

ALTRIA GROUP (NYSE:MO) DIVIDEND HISTORY BY QUARTER

| Announced |

Period |

Amount |

Yield |

Ex-Dividend Date |

Record Date |

Payable Date |

| 5/20/2021 |

Quarterly |

$0.86 |

6.88% |

6/14/2021 |

6/15/2021 |

7/9/2021 |

| 2/26/2021 |

Quarterly |

$0.86 |

7.72% |

3/24/2021 |

3/25/2021 |

4/30/2021 |

| 12/17/2020 |

quarterly |

$0.86 |

8% |

12/24/2020 |

12/28/2020 |

1/11/2021 |

| 7/28/2020 |

quarterly |

$0.86 |

8.17% |

9/14/2020 |

9/15/2020 |

10/9/2020 |

| 5/15/2020 |

quarterly |

$0.84 |

9.2% |

6/12/2020 |

6/15/2020 |

7/10/2020 |

| 2/27/2020 |

quarterly |

$0.84 |

8.34% |

3/24/2020 |

3/25/2020 |

4/30/2020 |

| 12/12/2019 |

quarterly |

$0.84 |

6.7% |

12/24/2019 |

12/26/2019 |

1/10/2020 |

| 8/22/2019 |

Quarterly |

$0.84 |

7.24% |

9/13/2019 |

9/16/2019 |

10/10/2019 |

| 5/17/2019 |

quarterly |

$0.80 |

6.11% |

6/13/2019 |

6/14/2019 |

7/10/2019 |

| 2/28/2019 |

quarterly |

$0.80 |

6.09% |

3/22/2019 |

3/25/2019 |

4/30/2019 |

Beijinger

2021. 6. 11. 02:09

2021. 6. 11. 02:09

2021년 6월 11일

2021년 6월 11일

| 종목명 |

티커 |

권리대분류 |

권리소분류 |

권리내용 |

권리락일 |

| NXP 세미컨덕터 |

NXPI.US |

배당 |

현금배당 |

0.5625USD(분기배당) |

2021년 6월 14일 |

NXP SEMICONDUCTORS (NASDAQ:NXPI) DIVIDEND INFORMATION

| NXPI Dividend Date |

7/6/2021 |

| NXPI Annual Dividend |

$2.25 |

| NXPI Dividend Yield |

1.12% |

| NXPI Three Year Dividend Growth |

0.00% |

| NXPI Payout Ratio |

33.19% (Trailing 12 Months of Earnings)

26.98% (Based on This Year's Estimates)

24.38% (Based on Next Year's Estimates)

16.12% (Based on Cash Flow) |

| NXPI Dividend Track Record |

1 Years of Consecutive Dividend Growth |

| NXPI Dividend Frequency |

Quarterly Dividend |

| NXPI Most Recent Increase |

$0.1880 increase on 3/4/2021 |

NXP SEMICONDUCTORS (NASDAQ:NXPI) DIVIDEND HISTORY BY QUARTER

| Announced |

PeriodPeriod |

Amount |

Yield |

Ex-Dividend Date |

Record Date |

Payable Date |

| 5/27/2021 |

Quarterly |

$0.5630 |

1.07% |

6/14/2021 |

6/15/2021 |

7/6/2021 |

| 3/4/2021 |

Quarterly |

$0.5630 |

1.24% |

3/12/2021 |

3/15/2021 |

4/5/2021 |

| 11/18/2020 |

Quarterly |

$0.3750 |

0.99% |

12/14/2020 |

12/15/2020 |

1/5/2021 |

| 9/1/2020 |

quarterly |

$0.3750 |

1.2% |

9/14/2020 |

9/15/2020 |

10/5/2020 |

| 5/28/2020 |

Quarterly |

$0.3750 |

1.56% |

6/12/2020 |

6/15/2020 |

7/6/2020 |

| 3/5/2020 |

quarterly |

$0.3750 |

1.5% |

3/13/2020 |

3/16/2020 |

4/6/2020 |

| 11/19/2019 |

Quarterly |

$0.3750 |

1.31% |

12/13/2019 |

12/16/2019 |

1/6/2020 |

| 8/29/2019 |

Quarterly |

$0.3750 |

1.47% |

9/13/2019 |

9/16/2019 |

10/4/2019 |

| 5/29/2019 |

Quarterly |

$0.25 |

1.1% |

6/13/2019 |

6/14/2019 |

7/5/2019 |

| 3/5/2019 |

Quarterly |

$0.25 |

1.09% |

3/15/2019 |

3/18/2019 |

4/5/2019 |

| 11/29/2018 |

Quarterly |

$0.25 |

1.2% |

12/13/2018 |

12/14/2018 |

1/7/2019 |

| 9/10/2018 |

Quarterly |

$0.25 |

1.12% |

9/24/2018 |

9/25/2018 |

10/5/2018 |

Beijinger

2021. 5. 22. 23:56

2021. 5. 22. 23:56

2021년 5월 22일

2021년 5월 22일

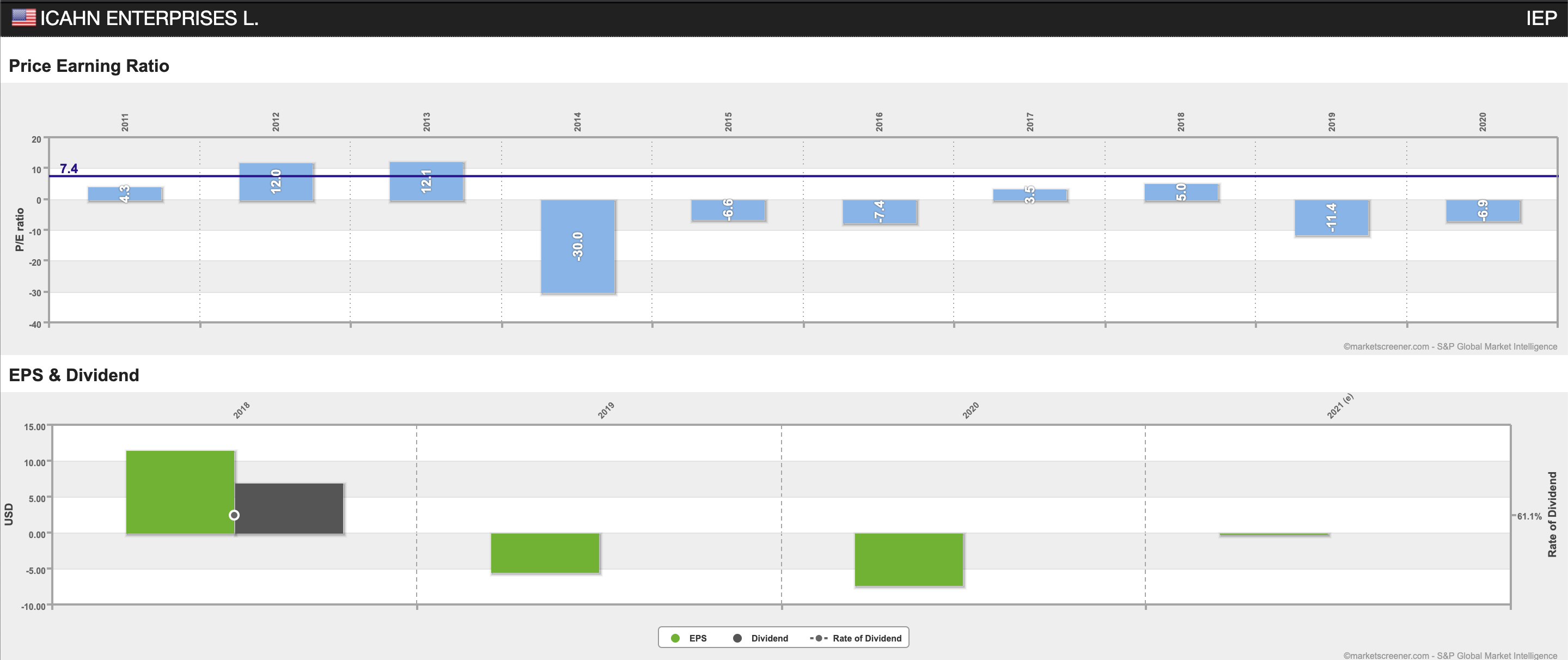

| 종목명 |

티커 |

권리대분류 |

권리소분류 |

권리내용 |

권리락일 |

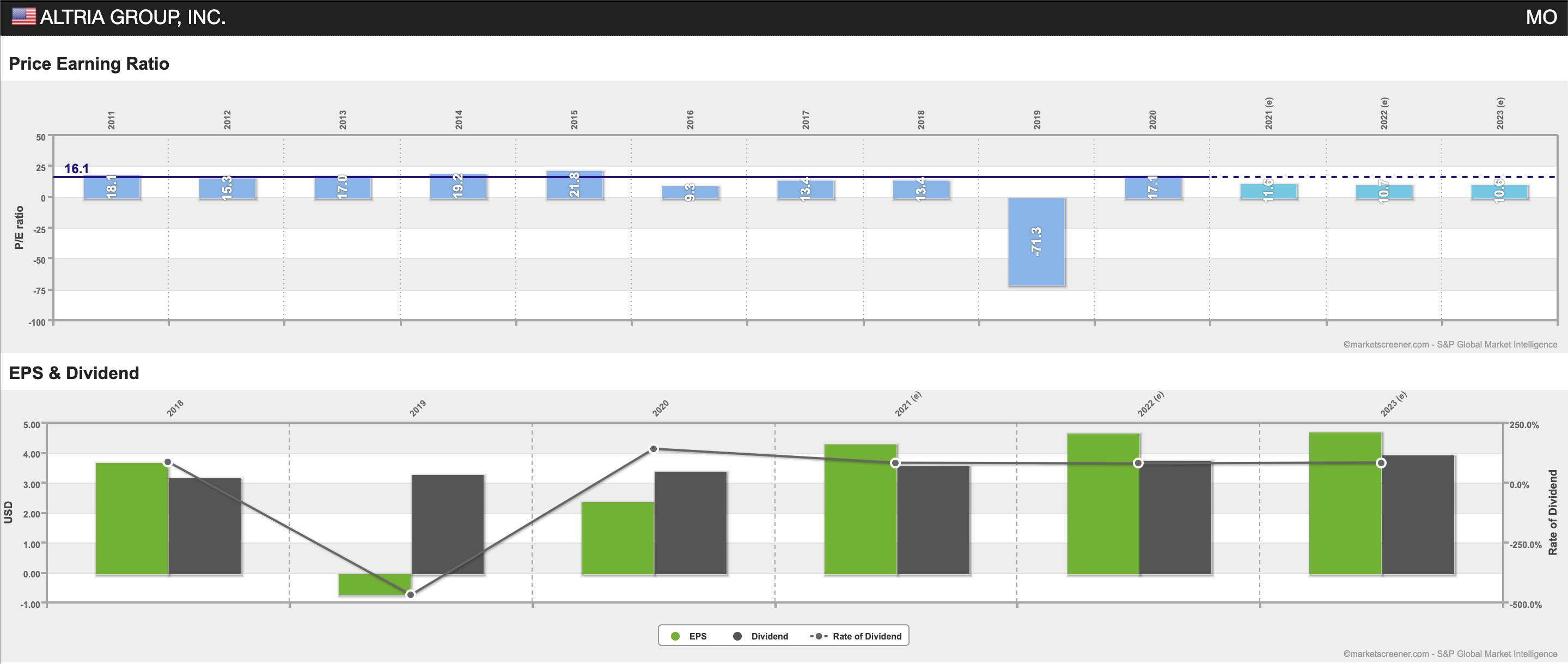

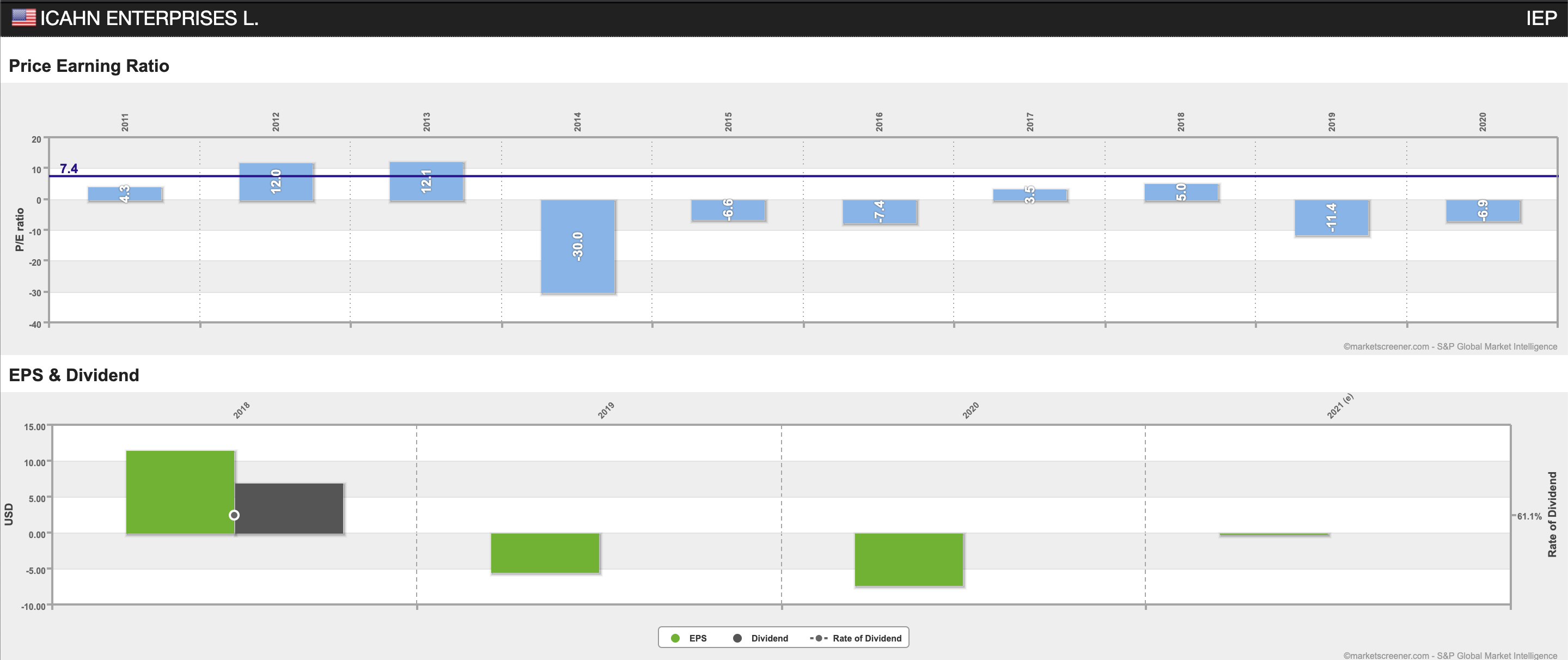

| Icahn Enterprise L.P. |

IEP |

배당 |

현금배당 |

2USD(분기배당) |

2021년 5월 28일 |

ICAHN ENTERPRISES (NASDAQ:IEP) DIVIDEND INFORMATION

| IEP Dividend Date |

6/30/2021 |

| IEP Annual Dividend |

$8.00 |

| IEP Dividend Yield |

13.93% |

| IEP Three Year Dividend Growth |

33.33% |

| IEP Payout Ratio |

N/A (Trailing 12 Months of Earnings)

N/A (Based on This Year's Estimates)

N/A (Based on Next Year's Estimates) |

| IEP Dividend Frequency |

Quarterly Dividend |

| IEP Most Recent Increase |

$0.25 increase on 3/1/2019 |

ICAHN ENTERPRISES (NASDAQ:IEP) DIVIDEND HISTORY BY QUARTER

| Announced |

Period |

Amount |

Yield |

Ex-Dividend Date |

Record Date |

Payable Date |

| 5/12/2021 |

quarterly |

$2.00 |

13.9% |

5/28/2021 |

6/1/2021 |

6/30/2021 |

| 3/1/2021 |

quarterly |

$2.00 |

13% |

3/25/2021 |

3/26/2021 |

4/28/2021 |

| 11/10/2020 |

quarterly |

$2.00 |

15.5% |

11/23/2020 |

11/24/2020 |

12/29/2020 |

| 8/10/2020 |

quarterly |

$2.00 |

14.4% |

8/20/2020 |

8/21/2020 |

9/29/2020 |

| 5/8/2020 |

Quarterly |

$2.00 |

15.7% |

5/18/2020 |

5/19/2020 |

6/25/2020 |

| 3/3/2020 |

quarterly |

$2.00 |

12.7% |

3/19/2020 |

3/20/2020 |

4/28/2020 |

| 11/1/2019 |

Quarterly |

$2.00 |

11.73% |

11/14/2019 |

11/15/2019 |

12/20/2019 |

| 8/2/2019 |

Quarterly |

$2.00 |

10.58% |

8/12/2019 |

8/13/2019 |

9/18/2019 |

| 5/3/2019 |

quarterly |

$2.00 |

10.65% |

5/10/2019 |

5/13/2019 |

6/20/2019 |

| 3/1/2019 |

quarterly |

$2.00 |

10.46% |

3/8/2019 |

3/11/2019 |

4/17/2019 |

Beijinger

2021. 5. 22. 23:30

2021. 5. 22. 23:30

2021년 5월 22일

2021년 5월 22일

| 종목명 |

티커 |

권리대분류 |

권리소분류 |

권리내용 |

권리락일 |

| 어플라이드 머티어리얼즈 |

AMAT |

배당 |

현금배당 |

0.24USD(분기배당) |

2021년 5월26일 |

APPLIED MATERIALS (NASDAQ:AMAT) DIVIDEND INFORMATION

| AMAT Dividend Date |

6/17/2021 |

| AMAT Annual Dividend |

$0.88 |

| AMAT Dividend Yield |

0.68% |

| AMAT Three Year Dividend Growth |

117.50% |

| AMAT Payout Ratio |

21.10% (Trailing 12 Months of Earnings)

17.71% (Based on This Year's Estimates)

15.94% (Based on Next Year's Estimates)

15.27% (Based on Cash Flow) |

| AMAT Dividend Track Record |

3 Years of Consecutive Dividend Growth |

| AMAT Dividend Frequency |

Quarterly Dividend |

| AMAT Most Recent Increase |

$0.02 increase on 3/13/2021 |

APPLIED MATERIALS (NASDAQ:AMAT) DIVIDEND HISTORY BY QUARTER

| Announced |

Period |

Amount |

Yield |

Ex-Dividend Date |

Record Date |

Payable Date |

| 3/13/2021 |

quarterly |

$0.24 |

0.82% |

5/26/2021 |

5/27/2021 |

6/17/2021 |

| 12/3/2020 |

quarterly |

$0.22 |

1.02% |

2/24/2021 |

2/25/2021 |

3/18/2021 |

| 8/31/2020 |

quarterly |

$0.22 |

1.43% |

11/18/2020 |

11/19/2020 |

12/10/2020 |

| 6/11/2020 |

quarterly |

$0.22 |

1.59% |

8/19/2020 |

8/20/2020 |

9/10/2020 |

| 3/13/2020 |

Quarterly |

$0.22 |

1.73% |

5/20/2020 |

5/21/2020 |

6/11/2020 |

| 12/9/2019 |

quarterly |

$0.21 |

1.5% |

2/18/2020 |

2/19/2020 |

3/11/2020 |

| 9/5/2019 |

Quarterly |

$0.21 |

1.68% |

11/20/2019 |

11/21/2019 |

12/12/2019 |

| 6/7/2019 |

Quarterly |

$0.21 |

2.02% |

8/21/2019 |

8/22/2019 |

9/12/2019 |

| 3/11/2019 |

quarterly |

$0.21 |

2.18% |

5/22/2019 |

5/23/2019 |

6/13/2019 |

| 12/7/2018 |

quarterly |

$0.20 |

2.31% |

2/20/2019 |

2/21/2019 |

3/14/2019 |